Back to Contents

| PDR – Managing your customer base |

| Manging the Client Base – Insurance companies |

| Managing the client base – Other partners |

Manging the Client Base – Insurance companies

Insurance companies are more important to keep on side than any other client since they provide or associated with a majority of the customer base. However, because of the size and structure of insurance companies, dealing with insurance companies is rather complex.

Insurance companies are more important to keep on side than any other client since they provide or associated with a majority of the customer base. However, because of the size and structure of insurance companies, dealing with insurance companies is rather complex.

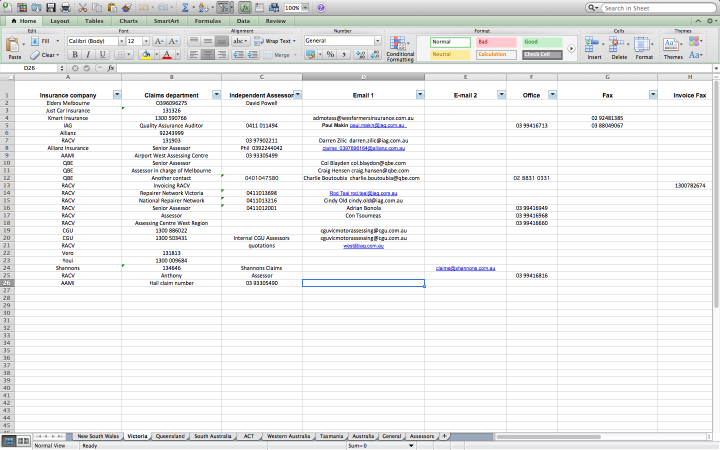

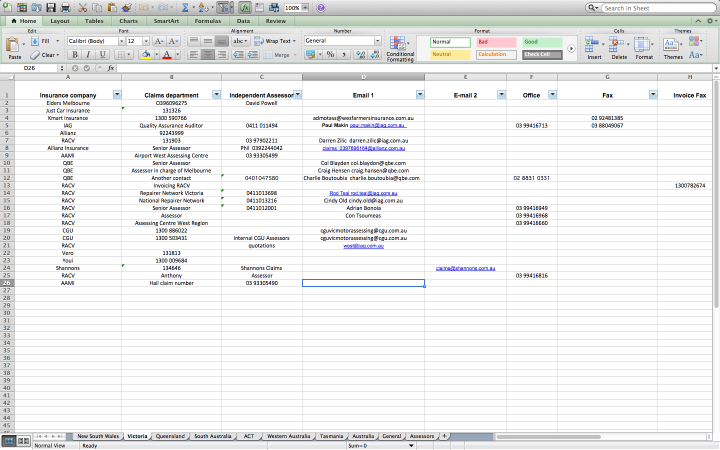

First, insurance companies are divided into states and sometimes regions. The procedures in contacting and of course submitting quotations insurance companies vary. Therefore, it is extremely important to keep a record of all insurance companies. This includes records of all assessors and their associated roles with the companies given they are often the main contact. This is especially true for the head assessors.

There are also companies that have acquired other insurance companies and consequently in some cases these companies have had to adopt the systems of the parent company. The two main dominant groups of companies have been IAG and Suncorp. The systems in these cases are almost very similar.

Insurance individually can also be complex. They all have different types of insurance including personal insurance, business insurance, and fleet insurance (I guess that apply to PDR at least). There have been cases where the procedures within these companies are different. For instance, in a special case of a fleet vehicle, its insurance was being managed by one contact. It took several switchboards between department to get through to this particular contact. The procedure of dealing with insurance was also unique in this particular case.

There have been moves in recent years where companies have formed contractual agreements with PDR companies and also panel shops. What this has done in the case of IAG for instance is to have all other companies send invoicing to PO Box addresses whereas the the partner PDR companies can have all invoicing handled online through their online system. Payment therefore is also much more rapid – a reminder here on how important it is to form bonds with companies.

Insurance Company Proposals

Partnership or preferred repairer programs are renewed every 3 years. It is important to at least attempt to develop some form of proposal to try and get a preferred program. These programs provide almost guaranteed work. The pricing structures will expect to be adjusted and there are expectations of being in the storm zones and set up with a premises usually within 48 hours.

There are specific procedures in applying for the preferred programs for each company and each would have to be contacted separately. It is important to have a respectable knowledge of the company before applying: their systems, their organisational structure, what their aims are in adopting such programs (almost guaranteed competitive pricing per vehicle and quality workmanship). Larger more established companies are more likely to be successful be it prestige, the volume of work handled, Australia wide operations, and perhaps years of contact with the insurance companies. It also seems that such partnerships have recently been narrowed down to few Australia wide.

The future

It seems that unless changing laws or new technologies in PDR enter the market, it is extremely difficult to foresee any changes partnerships to the main larger insurance companies and groups as preferred. It seems the possibilities that could arise are a drop in quality, damaged relationships or pricing structures. Carefully monitoring the industry as a whole is essential.